Best Practices for Reducing Check Fraud

Secure Business Checks

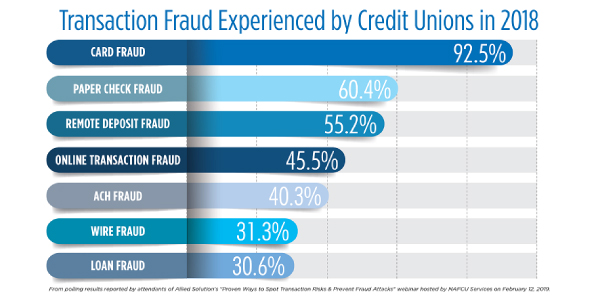

Check fraud costs American businesses and banks $50 billion each year. In 2018, the second most frequent type of transaction fraud experienced by Credit Unions was paper check fraud:

If you run a small business, check fraud is the last thing you need. Check fraud hits a company’s bottom line and disrupts business. Imagine the hassle of closing accounts, issuing stop payments, ordering new checks and reissuing payments. The concept is therefore straightforward: you need to take basic steps to protect yourself against the threat of check fraud.

Historically companies didn’t concern themselves with fraud because banks were held responsible for fraud losses. However, changes in the Uniform Commercial Code redefined liability for corporate check fraud to emphasize a greater responsibility on the business community. Example: If a bank offers their customer check stock that contains security features that could have prevented a specific case of fraud, the bank can claim that the customer was negligent and therefore at least partially responsible for the fraud loss.

Below is a partial list of prevention tips for businesses. When fighting check fraud, nothing is 100 percent. However, specific practices can complicate a criminal’s counterfeiting efforts. Make sure you are aware of best practices for reducing the risk of check fraud.

- Use blank check stock – pre-printed check stock makes fraud as easy as filling in the blanks. Use blank check stock in conjunction with a MICR laser check printing software.

- Use tightly controlled check printing procedures – ensure employees not involved in the accounting process do not have access to check printing equipment.

- Use check stock with security features that will help combat counterfeiting and alteration.

- Use positive pay – this type of payment system records pertinent information about each check such as the amount, the check number, bank information and date and then transmits it to the bank to be verified, before the check can be paid.

- Employ checks and balances – make sure that one person does not have access to the entire process. Fragment the procedures so that a persons activities will only affect a part of the process.

- Secure all reserve supplies of checks, deposit slips and other banking documents.

For a full product listing, download our Catalog sheet here.

If you have any questions regarding our DocuGard checks and/or security features, please feel free to Contact Us.

Follow Paris on social media for more.